by Flint Adam, Nolensville resident & REALTOR®

June was it. That’s when it happened. The circus left town.

A year and a half of constrained housing supply and frenzied sales finally drew to a close as, nationally, June 2022 brought the largest inventory spike on record, according to Realtor.com.

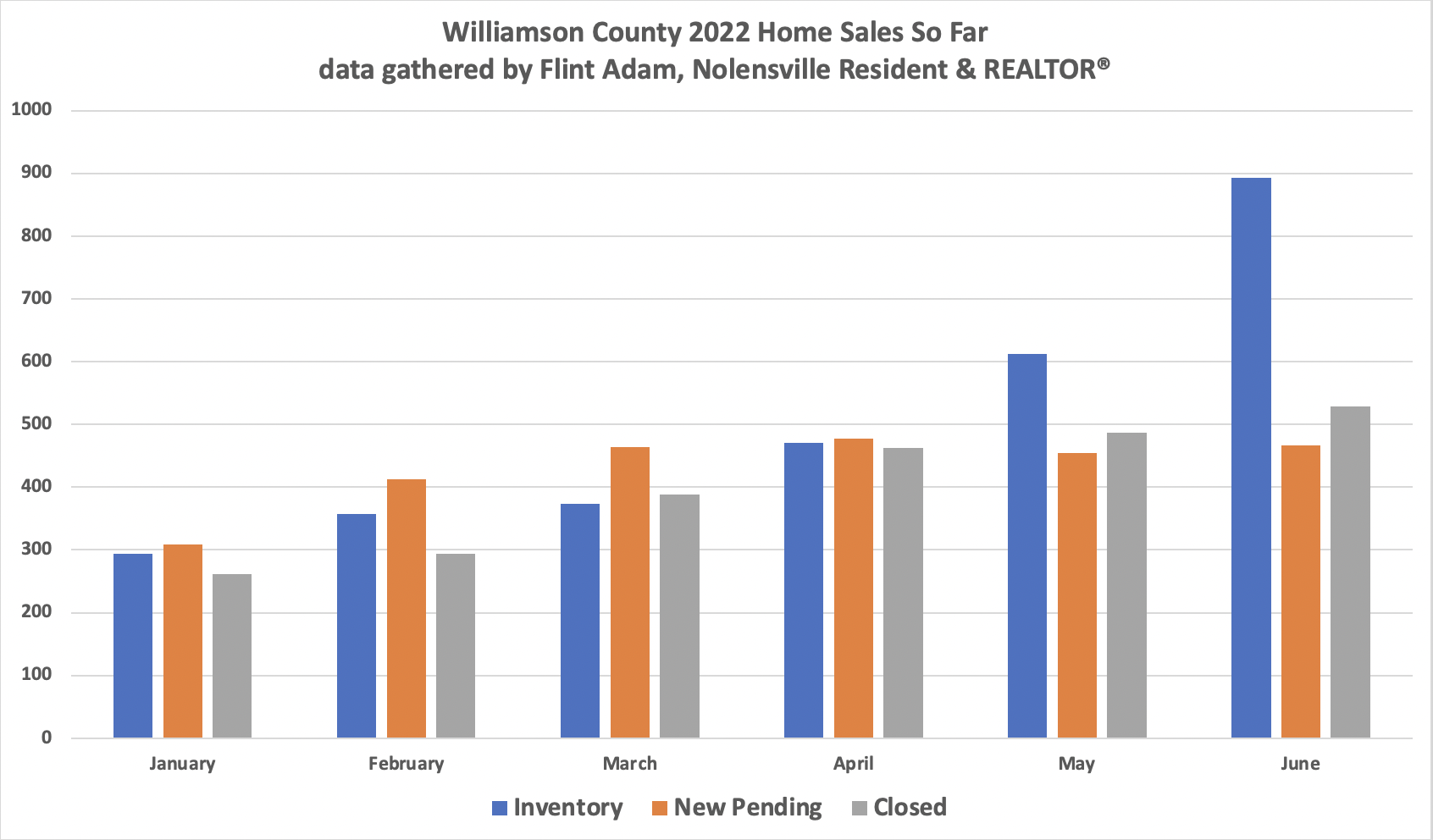

Williamson County certainly saw a swift increase in inventory, even as new monthly contracts remained fairly consistent.

Here in Nolensville each of the past five weeks, existing home inventory consistently sat around six to eight times higher than the number of new contracts coming in. That led to longer days on market (currently an average of 23 days for available, subdivision product), price reductions (46% of subdivisions resales on the market today have price-reduced), and even withdrawals from market (12 subdivision, existing homes left the marketplace over the past three months.)

New construction has been interesting to watch as well. A handful of contracts fell through and builders have had to put those properties back on the market. More telling, though, is that Beazer is offering buyer incentives now in Lochridge, and David Weekly Homes has reduced prices on several listings in Annecy. Both of these are big, corporate builders with product all over the country. They’re typically the first to react when market changes happen. Regional and local builders may eventually follow suit. Smaller, custom builders are probably beginning to stress as they are more sensitive to market and supply-chain changes and can quickly find themselves under water.

In fact, U.S. homebuilder sentiment (HMI) in July experienced one of the largest single-month drops in its 37-year history and dropped to its lowest level since May 2020, according to findings conducted by the National Association of Home Builders (NAHB) and Wells Fargo. (source, USA Today 7/19/2022).

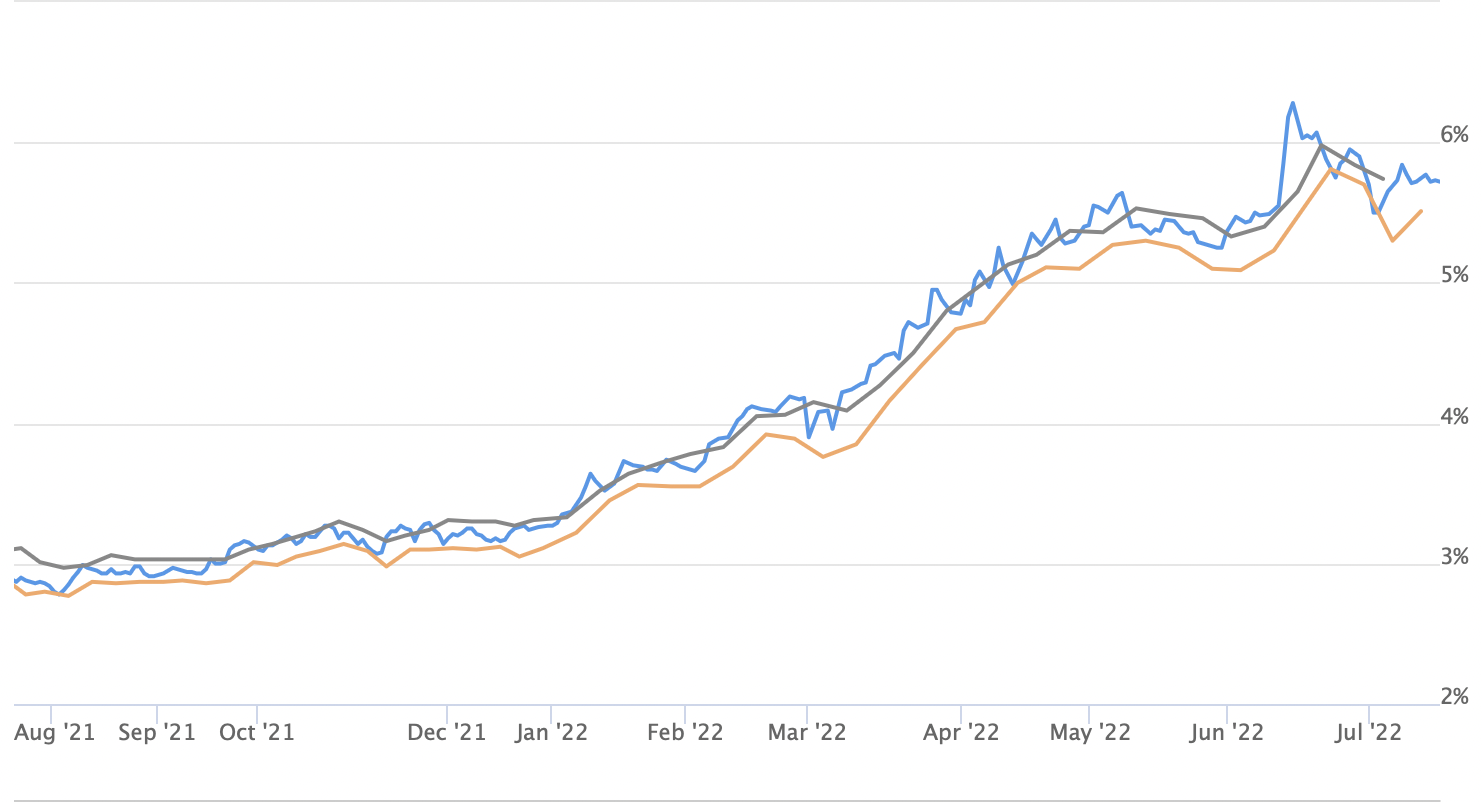

The swift rise in mortgage interest rates the past few months, along with a sudden bear market among stocks, and 40-year inflation highs have all contributed to the present slowdown.

It’s Not All Doom & Gloom…

However, there are bright spots. Those mortgage rates – they have stabilized since peaking around 6.3% for the 30-year fixed. The mid to high fives have been consistent for a few weeks now. With stability in interest rates, buyers are more willing to get back out there and look.

Price reductions and the return of contract contingencies for inspections, financing, and appraisals have also given buyers more comfort in moving forward. The playing field has leveled, which the market needed, and the need for housing remains!

We’re in the home stretch before the school year starts, and there’s also another prime rate hike expected by the Fed later this month. While that shouldn’t directly influence mortgage rates, we have seen correlation before, so, it stands to reason that both of these factors could become deadlines buyers want to beat!

Finally, there’s the simple truth that the market is really just stabilizing, folks. Back in July 2019, guess what the average days on market for a home sale was? 30 days! And back then that was still considered really fast.

Hang in there. Abrupt change always feels jarring, but we’re returning to a better place in real estate. It’s all going to be okay.

A Quick Note…

Before we get in-depth into last month’s numbers, I would like to announce that I recently became a Dave Ramsey Endorsed Local Provider.

This RamseyTrusted endorsement is only available to veteran REALTORS® who qualify with at least 35 transactions a year, apply for consideration, and are then vetted and hand-selected into Dave’s program.

If you are considering hiring a REALTOR® to sell your Nolensville home, I would love to earn your consideration. I have worked with more than 180 Nolensville families over the years and now carry the endorsement of Dave Ramsey, himself!

June 2022 Real Estate In Depth…

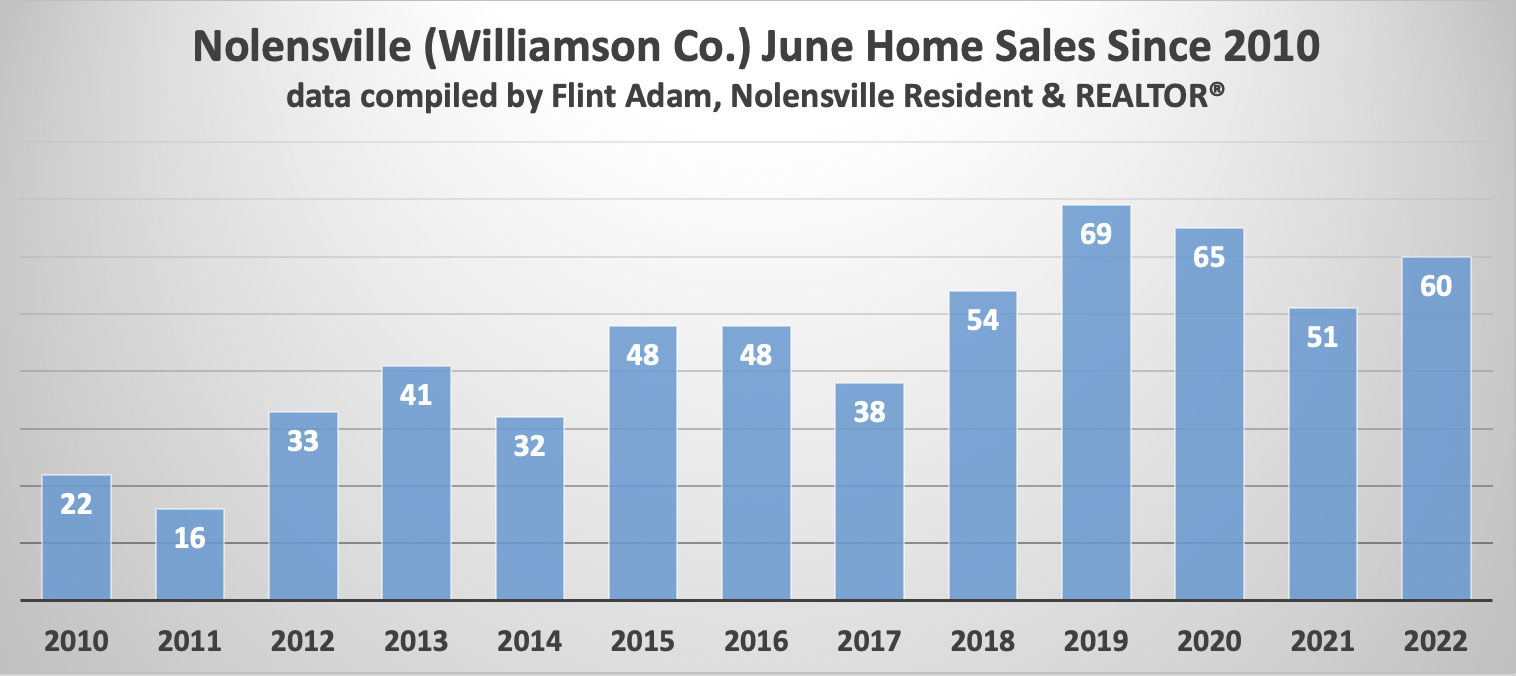

The competitive spring market is still propping up our monthly sales data, and June was no exception. Sixty home sales closed last month, creating the third-most active June in Nolensville history.

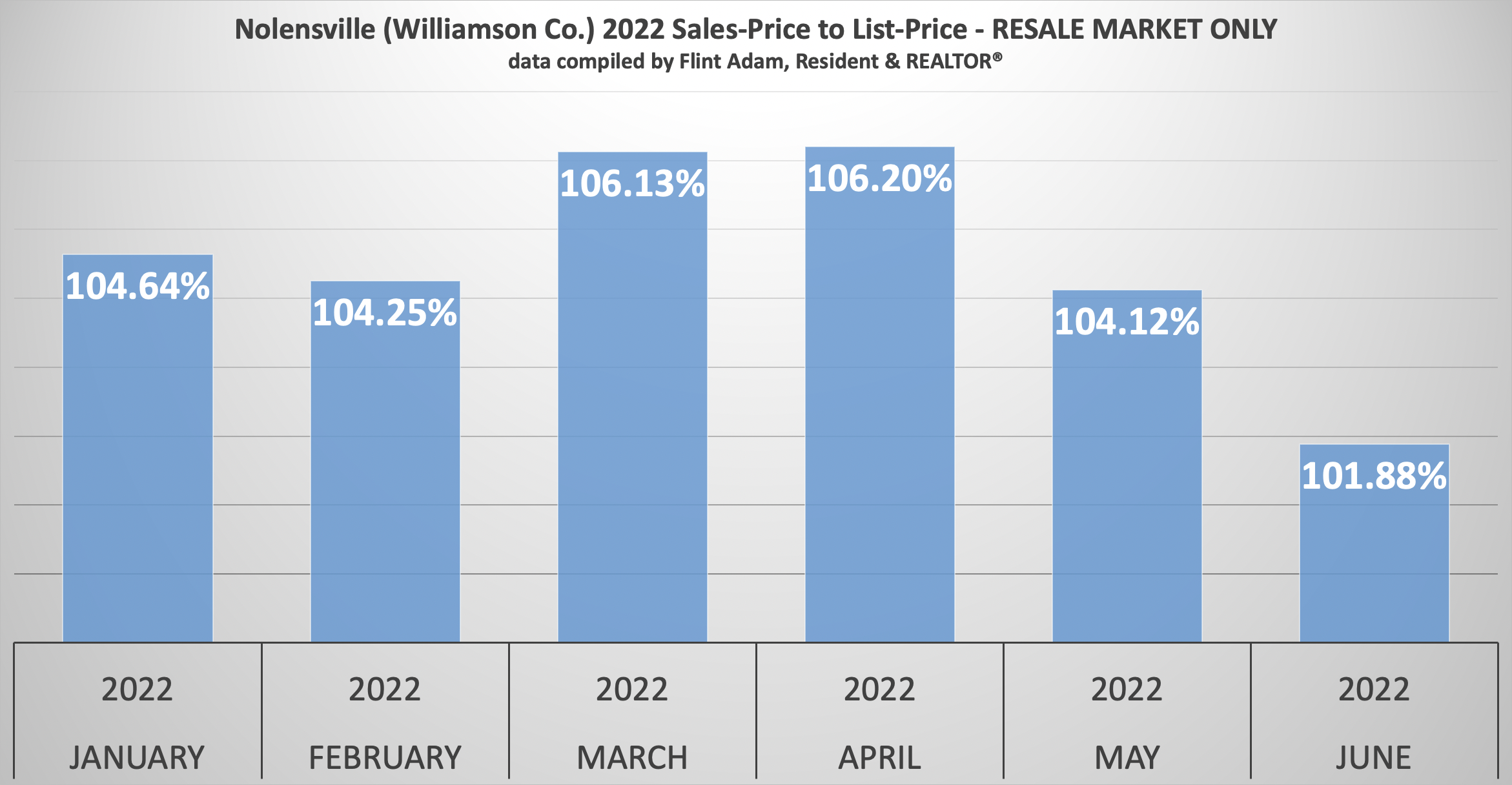

The number of bidding wars, though, continued their slide as the average sales-price to list-price ratio in the resale market further declined to just 1.88% above asking price… the lowest figure we have seen since October 2021, and well off the pace from a year ago.

Meanwhile, the median sales price in Nolensville jumped, month-over-month (+4.97%), and was also up (25.9%) from a year ago.

June 2022 vs. June 2021 Nolensville Home Sales:

- 60 Nolensville (Williamson Co.) homes sold… up from 51 (+17.65%)

- The median sales price was $888,320… up from $705,550 (+25.90%)

- The average days on market was 6… down from 7 (-1 day)

- The sales-price to list-price ratio was 101.14%… down from 103.01% (-1.82%)

- 32 of the 60 homes (53%) sold were new construction

- The lowest price sale was 1097 Kirkpark Court in Lochridge for $686,685.

- The highest price sale was 1057 Annecy Pkwy. in Annecy for $1,673,600.

Deeper Dive:

- When we eliminate new construction and larger acreage properties and look solely at subdivision resales (27 total), some interesting figures come to light:

- The median sales price becomes $970,000

- The average sales-price to list-price ratio grows to 101.85%

- 12 of the 27 sales (44%) are above asking-price (down 30% from the month before)… anywhere from $18 to $100,100

- 7 of the 27 sales sold (26%) below asking-price (a 23% rise from the month before).

- The average overage of the above-asking price sales is $72,550

- All-cash purchases make up 15% of sales

- The average days on becomes 7

- 2 of the resales had a contract fall through before selling

- 6 of the resales (22%) had to price-reduce before going under contract

*Note: The information above cites Williamson County sales data for Nolensville, Tennessee. There is, of course, a small percentage of Nolensville homes that exist in Davidson and Rutherford counties, but for continuity in my blogging I reference only Williamson County statistics.

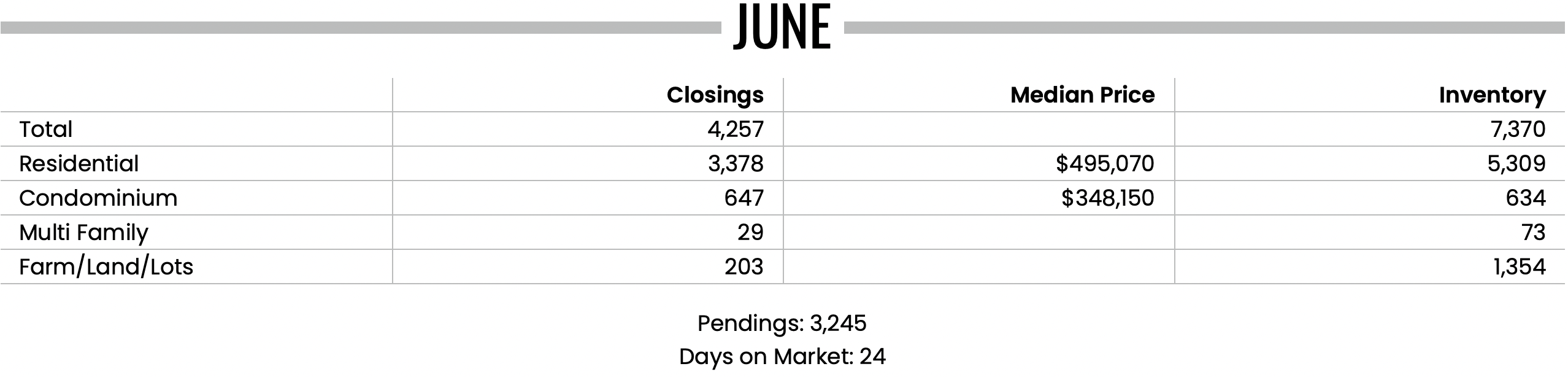

Williamson County Sales Stats…

Williamson County housing inventory had another significant gain last month, rising 46% compared to May… which was up 30% from April.

Williamson County housing inventory had another significant gain last month, rising 46% compared to May… which was up 30% from April.

Compared to June 2021, there was 94% more housing inventory in Williamson County compared to the year before!

Meanwhile, there were only 2.94% more new contracts in June compared to the month before… and they were down 11.89% from the year prior.

Greater Nashville Sales Stats (includes Williamson Co.)…

New contracts across Greater Nashville sunk 4.02% compared to May while inventory increased across the board.

Where Does It Go From Here?…

Balance is finally returning to the marketplace! While the 2022 total real estate data still looks horribly out of whack compared to historical figures, days on market have shot up in July and the sales-price to list-price ratio has been heading down.

Buyers currently have the widest selection to choose from, and the most leverage at the negotiating table that they have seen in two years.

2022 (year-to-date): 6 days on market | 102.59% Sale Price to List Price Ratio

2021: 7 days on market | 102.66% Sales Price to List Price Ratio

2020: 19 days on market | 99.07% Sales Price to List Price Ratio

2019: 30 days on market | 98.4% Sales Price to List Price Ratio

2018: 30 days on market | 98.57% Sales Price to List Price Ratio

2017: 26 days on market | 98.63% Sales Price to List Price Ratio

2016: 33 days on market | 98.70% Sales Price to List Price Ratio

2015: 32 days on market | 98.40% Sales Price to List Price Ratio

2014: 36 days on market | 97.35% Sales Price to List Price Ratio

2013: 42 days on market | 97.64% Sales Price to List Price Ratio

2012: 57 days on market | 97.66% Sales Price to List Price Ratio

If you’re interested in buying or selling, it’s time to talk.

Give me a call at 615-500-6393 or email me at flint@theguidehome.com and let’s chat about your goals. It may be best for you to stay put, and if so – I’ll give you that honest opinion. But if there’s a window of opportunity, I’m going to help you open it right on up.

Interested in up to date Nolensville TN real estate sales figures? I’ll email you an HOURLY UPDATED look at Nolensville real estate activity including what has gone pending, price-reduced, and withdrawn. Just shoot me an email with your name and preferred email address to flint@theguidehome.com

The Latest on Mortgage Rates…

7/21/2022 Commentary by Nolensville resident, Jesse Alvarez, with The Mortgage Exchange

7/21/2022 Commentary by Nolensville resident, Jesse Alvarez, with The Mortgage Exchange

As home sales continue to drop, mortgage rates have leveled off into a sideways range (although we are currently sitting near the top of that range). Mortgage demand continues to weaken each month, so as inflation pressures continue to push treasuries higher, weakening mortgage demand should slow down the effect rising treasury yields will have on the mortgage market.

Other developed economies around the world are also just now beginning to see the record inflation numbers that we’ve been seeing over the last six months, so their central banks have started to finally take action. One would think these central bankers would take notice of the late start that the United States had on trying to contain inflation and it would lead them to preemptively raise rates in their own country to get out in front of things. But at the end of the day they are just as arrogant as our Central Bankers here, so admitting they were also wrong just isn’t an option. They had to wait until they actually saw the record inflation numbers before they were going to give a damn. The good news out of this is that the world is finally completely awake to inflation and Central Banks everywhere have begun tightening rates. Some have even decided to do it with emergency central bank meetings.

This will help the U.S. rein in inflation quicker. As those governments force consumers to slow down their demand for good and services (and force recessions (which they refuse to admit are recessions), it has and will begin to ease up supply chain issues worldwide. The faster other countries begin to go into recession, or near recession, the faster our own inflation will recede. The world will be watching our monthly inflation numbers carefully as they know that they won’t get their problems under control until after we pull through ours first.

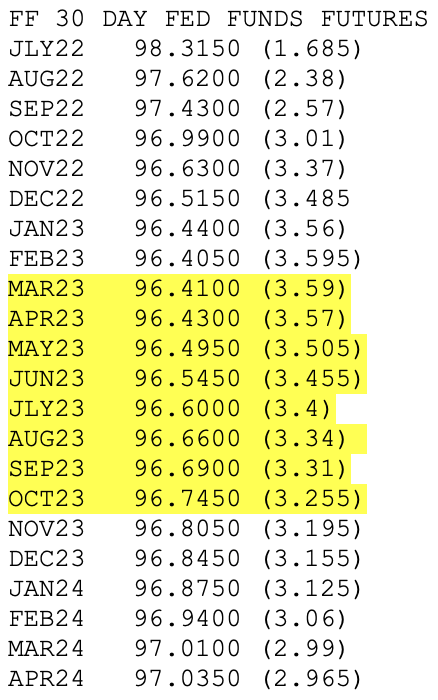

Fed Fund Futures are currently showing rates being lowered again in mid 2023, as you can see below by todays futures pricing. These prices are fluid and can change dramatically over short periods of time, but they do give a good indication of when rates will begin to really lower again. I’ve highlighted the areas to take note of. Based on this pricing, I would expect mortgage rates to slowly drift higher until early to mid 2023, and then begin their permanent decent at some point around then. If this pricing turns out to be correct, you would begin to see dramatically lower mortgage rates in 2024. Seems like a long ways from now, but when looking at things from a historical perspective, it’s right around the corner.

Fed Fund Futures are currently showing rates being lowered again in mid 2023, as you can see below by todays futures pricing. These prices are fluid and can change dramatically over short periods of time, but they do give a good indication of when rates will begin to really lower again. I’ve highlighted the areas to take note of. Based on this pricing, I would expect mortgage rates to slowly drift higher until early to mid 2023, and then begin their permanent decent at some point around then. If this pricing turns out to be correct, you would begin to see dramatically lower mortgage rates in 2024. Seems like a long ways from now, but when looking at things from a historical perspective, it’s right around the corner.

Flint Adam is a 12- year Nolensville resident and lives with his wife and children in Bent Creek. He focuses his real estate practice here in town, having served more than 180 buyers and sellers in closed Nolensville real estate transactions. Flint enjoys blogging about local real estate, traveling the world, photography, and hiking. He is passionate about serving Nolensville and keeping it one of America’s greatest small towns.