by Flint Adam, Nolensville resident & REALTOR®

In last month’s blog, I mentioned a point in time where I felt we had begun a market-transition. Fast-forward 30 days and the evidence is growing that our real estate market is peaking (or has already peaked), and buyers and sellers will need to recalibrate expectations.

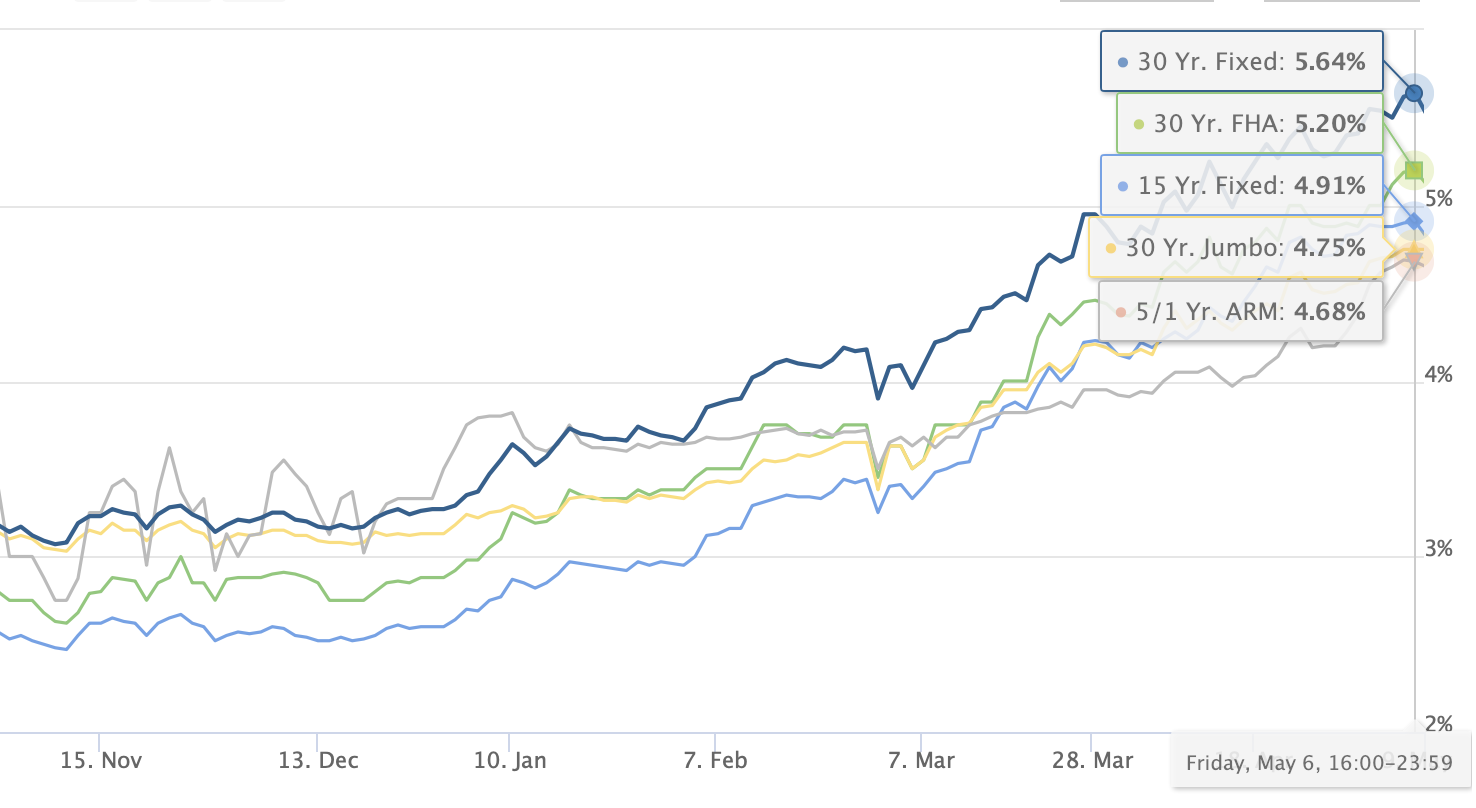

As I write this, the 30-year, conventional mortgage rate for a well-qualified buyer has risen above 5.5% – the highest it has been since 2009. Meanwhile, some national headlines…

- housing-inventory is beginning to rebound…

- a record share of home sellers have dropped prices…

- inflation is a persistent threat to family’s budgets…

- gas prices are at all-time highs…

- food prices keep heading north…

- the stock market is on a 5-week run of losses…

- the global supply chain remains a mess…

- and everyone is pretty damn exhausted!

Whew.

Okay, now let’s step back from the ledge. It’s still a seller’s market, folks.

Despite all of the above, there remain more people across the country seeking home ownership than there are homes to buy. What’s happening now, though, is the cost of borrowing has gone up quite a bit.

Couple these rising interest rates with other, everyday expenses that are higher, and some people are either priced out of buying or they’re just being more selective.

Couple these rising interest rates with other, everyday expenses that are higher, and some people are either priced out of buying or they’re just being more selective.

What this means is “the crazy” in our marketplace may be going away… but not “the need”. If you have a home to sell, it’s priced within reason, and you’ve taken care of it – it’s still going to sell!

Yes, yes, I’m sure it’s deflating for the would-be sellers out there who have marveled at stories of 14 competing offers, occupancy for four months after the sale, and $40,000 over asking-price. It was a historic run.

That part is about over now.

So, back to the fundamentals. You can’t just throw something out there and expect gold in return. Honestly, this is the best news we could have hoped for. The housing market is not a bubble, it’s not going to pop. It’s going to normalize.

Normalizing will include some price-reductions. It will include double-digit days on market. It will include having to leave your house the days it sells… you know, normal real estate conditions.

But this train will keep on moving, it may just not be so fast. A lot of REALTORS®, and I’m sure virtually all of the buyers out there, will be okay with this.

What’s Happening Out There Right Now?…

When you work in real estate every day you begin feeling a rhythm in the marketplace. I first noticed a change in tune about five weeks ago, and it has become only more pronounced since then.

I have been fortunate to work with 14 Nolensville buyers and sellers so far this year, and have been the listing agent for homes in five different Nolensville neighborhoods during that time. So, I have seen first-hand a variety of price points, offers, showings, you name it.

As you’ll see below, the April sales data in Nolensville remains very strong, but it’s a lagging indicator. The results come largely from activity that was happening a month or two before. (A typical sales cycle among resales is still around 30 to 45 days.)

What I saw with homes on the market during April was that showings were typically way down from where they had been, the number of offers received had dropped substantially, and selling prices were typically still above asking-price, but not as strong as they had been in prior months. That said, there remained some hot properties that were still gathering a large crowd and selling well-above asking… but they were not nearly as plentiful as they had been.

In short, I’m seeing a mixed bag out there, and buyers are scrutinizing homes more than they have been.

Thirty-three existing homes (in subdivisions) have listed for sale in Nolensville since April 1st. Three of those reduced their asking price. That’s 9% of the inventory. Not huge, mind you, but there have been recent months where I didn’t see a single price-reduction.

Meanwhile, two of those thirty-three homes (6%) had a contract fall through. That’s another low number, but again, it’s more than I have seen in recent months.

Finally, I’m seeing more homes take longer than a weekend to sell. Of the seven Nolensville resales listed as available right now (May 10, 2022), six of them are on their fifth day on market. (The seventh had a contract fall through and is back on the market today).

None of this is Earth-shattering news, and all indications are that we’ll remain in a seller’s market with various levels of competition per listing. I just see signs of softening.

I’m telling the prospective sellers I’m interviewing with that they should temper expectations, have patience, price correctly and make sure the house shines! They’ll still do really well in the sale.

As for buyers… while interest rates are higher, inventory is growing and more opportunity should be available soon.

April 2022 Real Estate In Depth…

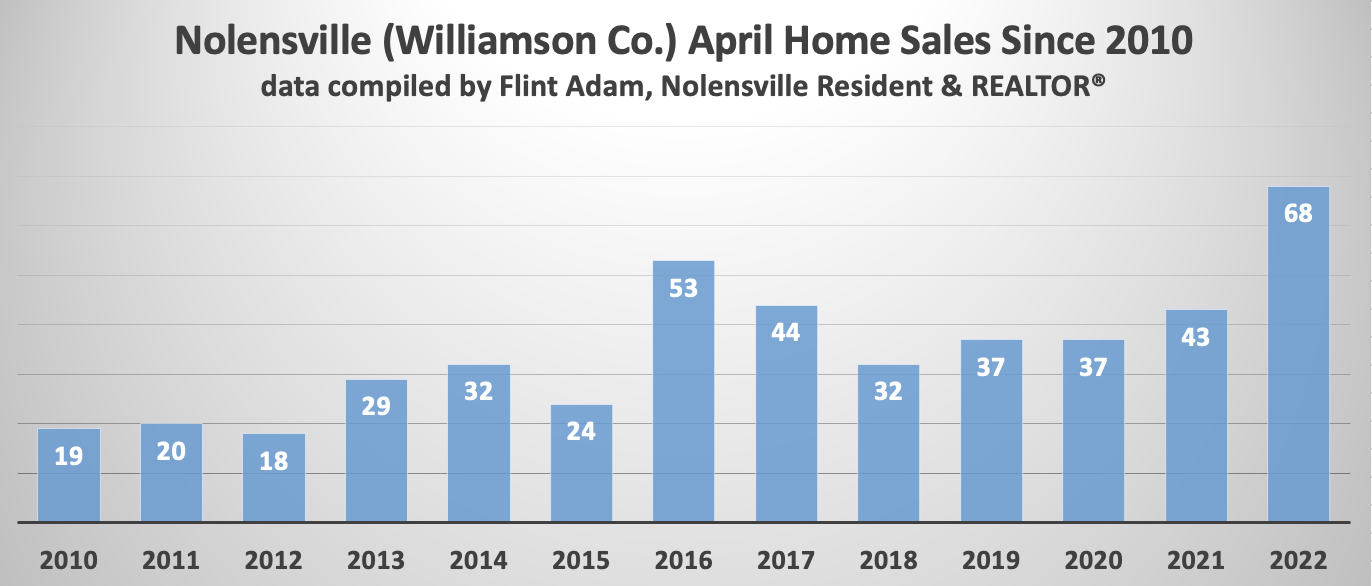

The most interesting number to me from last month’s sales data was the total number of homes sold. There were 68* closings last month – a new April record! In fact, last month’s closings were up 58% compared to April 2021… and beat out the prior April record set in 2016 by 28%.

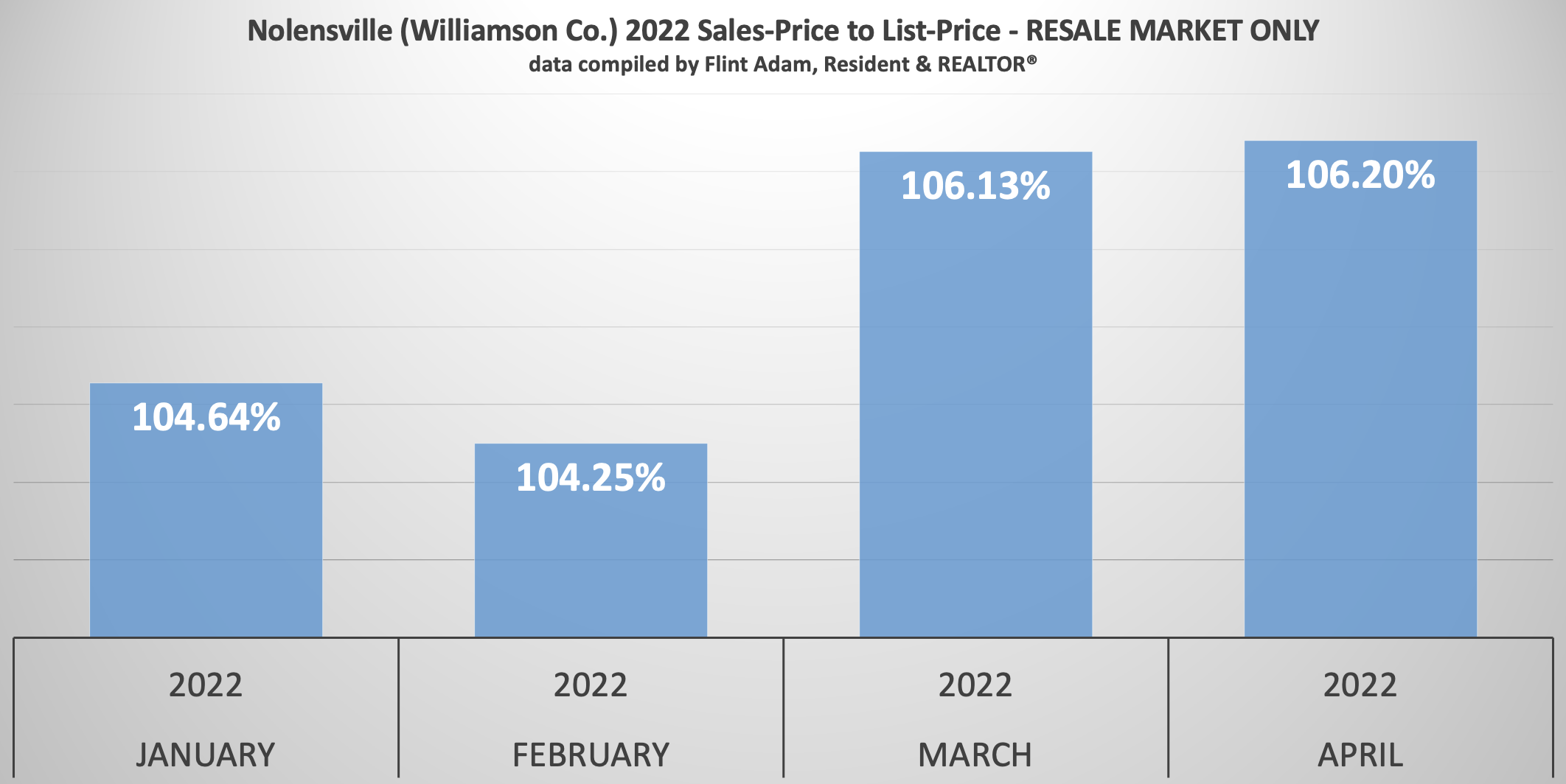

The bidding wars, though, may have peaked last month. The average sales-price to list-price ratio remained almost in-line with March… averaging 6.2% above asking-price in the resale market.

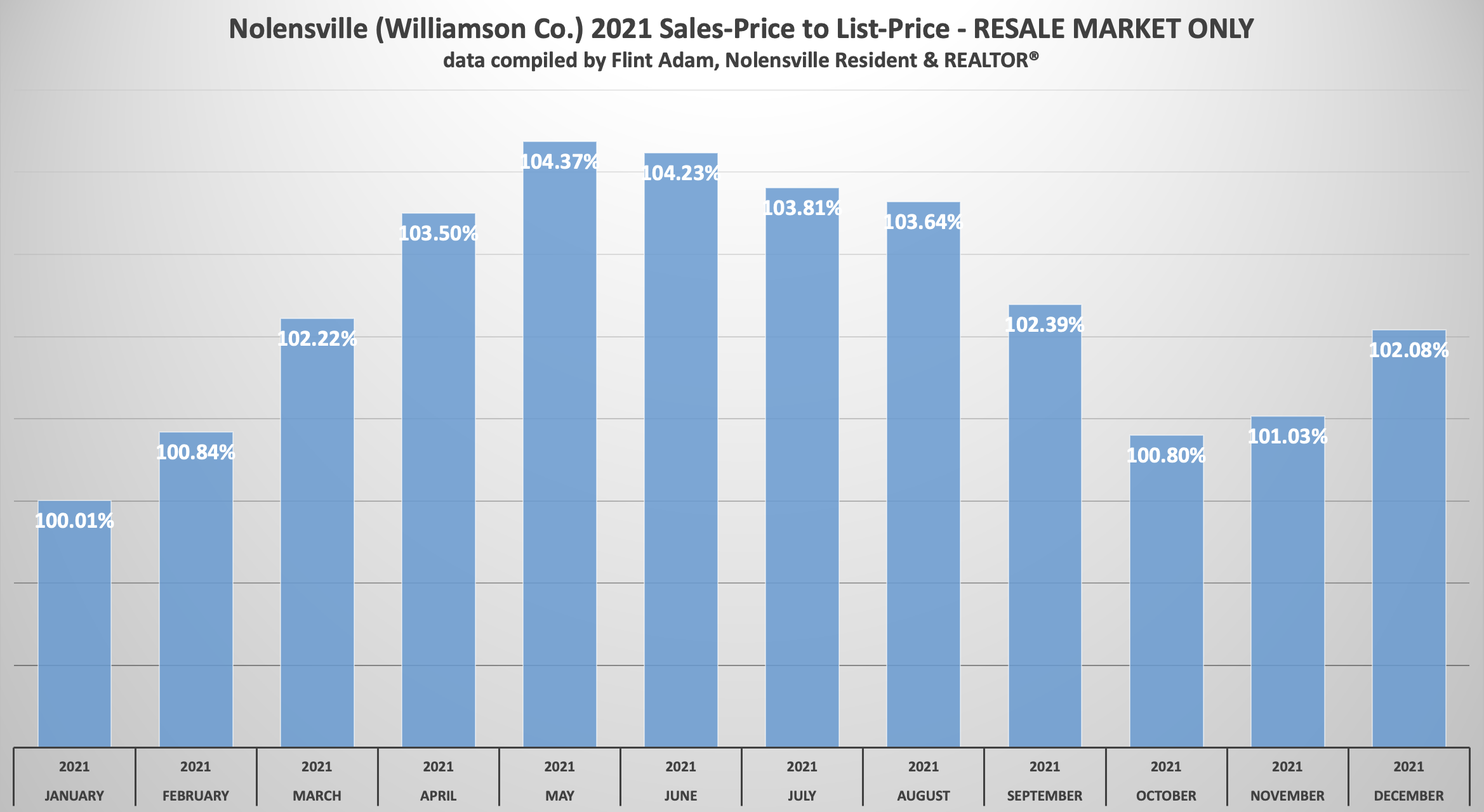

That marks the highest figure we have seen since the pandemic-fueled rush on real estate began during spring of 2021.

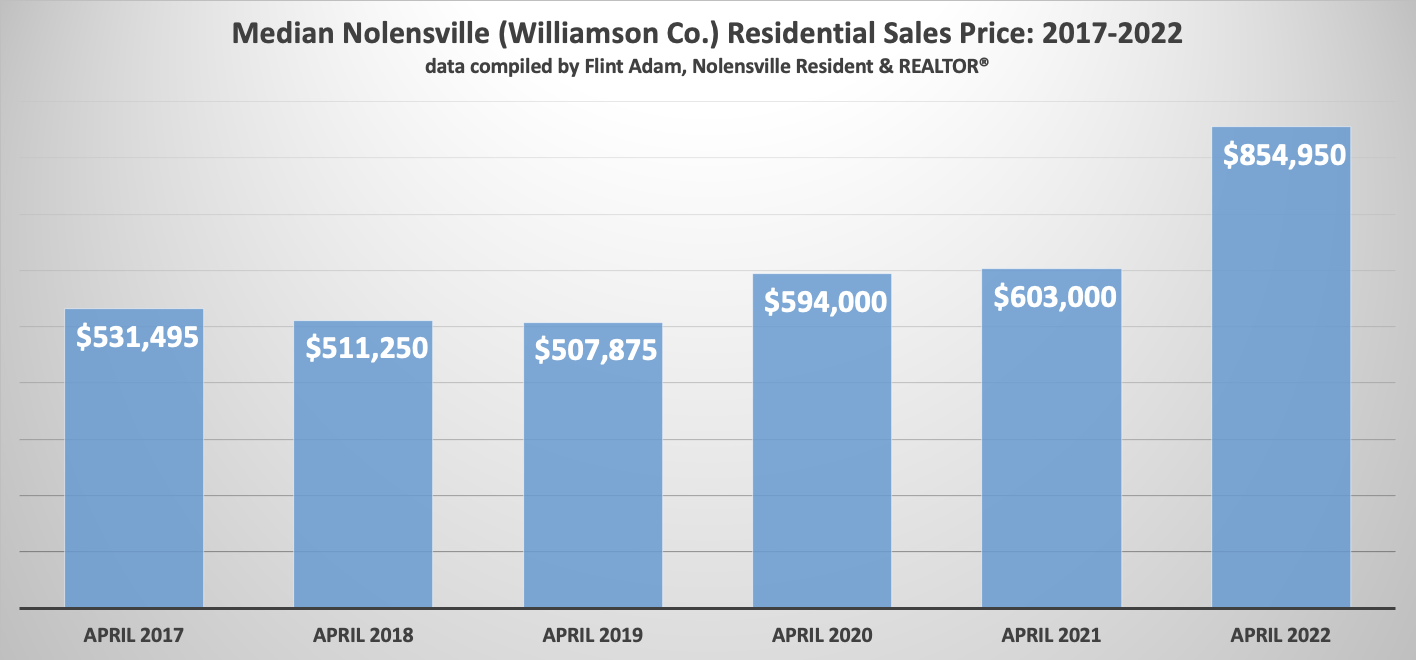

The median sales price in Nolensville dipped slightly (-2.28%) from last month, but was still an astronomical 41.78% higher than it was the year before.

April 2022 vs. April 2021 Nolensville Home Sales:

- 68 Nolensville (Williamson Co.) homes sold… up from 43 (+58.14%)

- The median sales price was $854,950… up from $603,000 (+41.78%)

- The average days on market was 4… down from 8 (-4 days)

- The sales-price to list-price ratio was 103.76%… up from 102.28% (+1.45%)

- 30 of the 68 homes (44%) sold were new construction

- The lowest price sale was 1101 Kirkpark Ct. in Lochridge for $579,490.

- The highest price sale was 148 Asher Downs Circle for $1,541,100.

And here are some of the crazy facts:

- When we eliminate new construction and larger acreage properties and look solely at subdivision resales (37 total), some extraordinary figures come to light:

- The median sales price becomes $945,000

- The average sales-price to list-price ratio grows to 106.36%

- 24 of the 37 sales (65%) are above asking-price… anywhere from $20,100 to $250,000

- 2 of the 37 sales sold (5%) below asking-price.

- The average overage of the above-asking price sales is $89,056

- All-cash purchases make up 27% of sales

- The average days on becomes 5

- 1 of the resales had a contract fall through before selling

- 1 of the resales had to price-reduce before going under contract

*Note: The information above cites Williamson County sales data for Nolensville, Tennessee. There is, of course, a small percentage of Nolensville homes that exist in Davidson and Rutherford counties, but for continuity in my blogging I reference only Williamson County statistics.

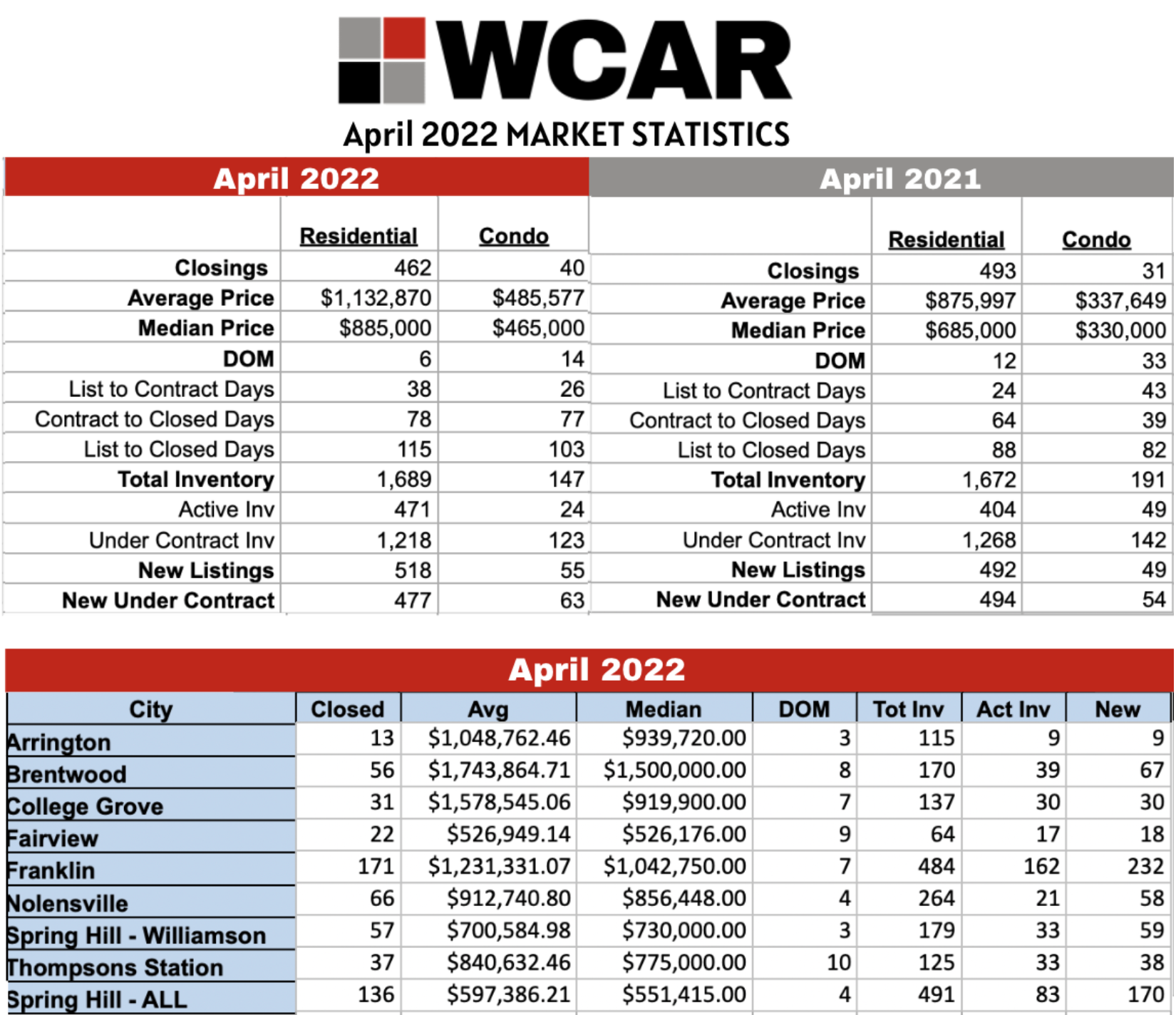

Williamson County Sales Stats…

Active inventory in Williamson County improved 26% over March despite only 5% more listings coming to market compared to the month before. That tells us that some homes are sitting, helping inventory grow.

Newly under contract listings grew only 3% from the month before.

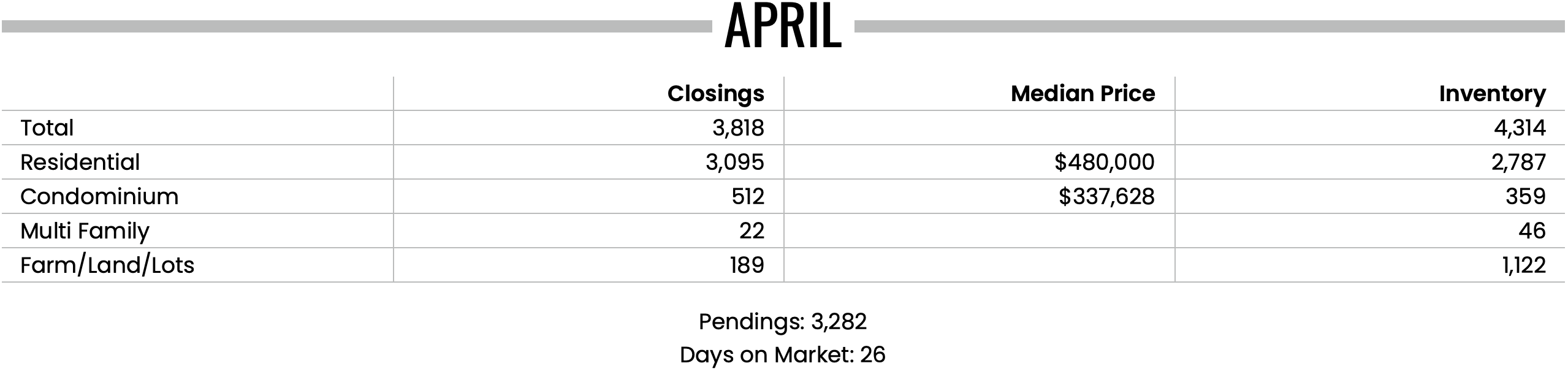

Greater Nashville Sales Stats (includes Williamson Co.)…

Housing inventory across Greater Nashville climbed 17% compared to the month before, but the number of homes sold dipped 7% compared to the year before.

Where Does It Go From Here?…

In order for the market to balance, we’re going to need more inventory, fewer bidding wars, and see days on market move back up. Here’s a look at how the existing homes (resale) market in Nolensville (Williamson County) has fared with days on market and SP/LP % over the past decade:

2022 (year-to-date): 3 days on market | 106.21% Sale Price to List Price Ratio

2021: 7 days on market | 102.66% Sales Price to List Price Ratio

2020: 19 days on market | 99.07% Sales Price to List Price Ratio

2019: 30 days on market | 98.4% Sales Price to List Price Ratio

2018: 30 days on market | 98.57% Sales Price to List Price Ratio

2017: 26 days on market | 98.63% Sales Price to List Price Ratio

2016: 33 days on market | 98.70% Sales Price to List Price Ratio

2015: 32 days on market | 98.40% Sales Price to List Price Ratio

2014: 36 days on market | 97.35% Sales Price to List Price Ratio

2013: 42 days on market | 97.64% Sales Price to List Price Ratio

2012: 57 days on market | 97.66% Sales Price to List Price Ratio

If you’re interested in buying or selling, it’s time to talk.

Give me a call at 615-500-6393 or email me at flint@theguidehome.com and let’s chat about your goals. It may be best for you to stay put, and if so – I’ll give you that honest opinion. But if there’s a window of opportunity, I’m going to help you open it right on up.

Interested in up to date Nolensville TN real estate sales figures? I’ll email you an HOURLY UPDATED look at Nolensville real estate activity including what has gone pending, price-reduced, and withdrawn. Just shoot me an email with your name and preferred email address to flint@theguidehome.com

The Latest on Mortgage Rates…

5/10/2022 Commentary by Nolensville resident, Jesse Alvarez, with The Mortgage Exchange

5/10/2022 Commentary by Nolensville resident, Jesse Alvarez, with The Mortgage Exchange

As I sit and write this, mortgage rates have moved above 5.5% for the time being. Seems really high, right? Well, it’s not. It just seems high because we’ve been fortunate enough to be sitting lower then that for the last ten years or so. Historically, U.S. mortgage rates have averaged 7.78% since 1971, so we are still in a pretty good spot. It appears as though this freight train is out of the station and there is no way to stop it. 6% is probably not that far away, with 7% looking like most economists top for this upward rate cycle.

If you have been unfortunate enough to have missed the boat on low rates, there are still a few good programs out there for you. There are a handful of Portfolio lenders who are offering Adjustable Rate Mortgages (ARM’s) with rates in the upper 3’s or lower 4’s depending on credit scores and length of ARM. This gives you the opportunity to get a much better rate and saving good money while waiting for the next low rate cycle to appear. Mortgage rates historically drop within three to four years of their cyclical peak and this cycle should be no different. My personal opinion is that a 7 year ARM is the way to go right now. Locking in something in the low 4’s for the next 7 years should buy most consumers enough time to refinance into a lower 30 year fixed rate in the not too distant future.

If looking at ARM options, just be aware of a few things: ARM’s are locked for the duration of the ARM length while being amortized over 30 years. So for example, a 7 year ARM would be locked for seven years but amortized over 30. So the payment is spread out like a 30 year loan. A 10 year ARM would be locked for ten years and amortized over 30 and so on and so forth. After you reach the end of the lock period, your rate will become adjustable. At that point (or at any point before) you could refinance into a fixed product. Most people wait for rates to drop and refinance into a lower rate before the ARM resets. You do run the risk of rates being higher when the ARM resets, so there are risks involved if you just let the loan play out without looking to refinance it at all. There are caps to how high the rate can go in both one year and also during the life of the loan, so you would never wake up with a 20% mortgage rate, but you could wake up and have a payment that is several hundred dollars a month more expensive. Speaking to your own financial adviser is always a smart bet when making decisions like these. Don’t just trust any lender out there, not all of them are as nice as I am!

Flint Adam is a 12- year Nolensville resident and lives with his wife and children in Bent Creek. He focuses his real estate practice here in town, having served more than 180 buyers and sellers in closed Nolensville real estate transactions. Flint enjoys blogging about local real estate, traveling the world, photography, and hiking. He is passionate about serving Nolensville and keeping it one of America’s greatest small towns.